Premium Bonds

Then either call 08085 007 007 or go to the NSI site and login. For example a 500 bond that trades for 525 is a premium bond.

Can I Get Back 22k Premium Bonds I Bought Estranged Son This Is Money

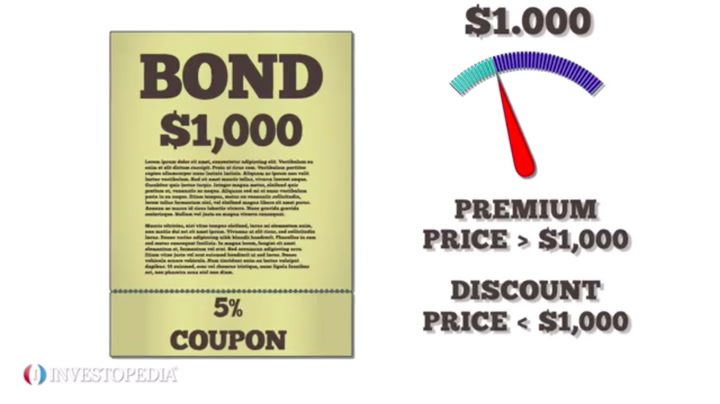

This happens when the bonds coupon rate exceeds the prevailing.

. However for many people thats no longer a bonus. It is a legitimate mind-bender for investors as it would seem. For example if you invest.

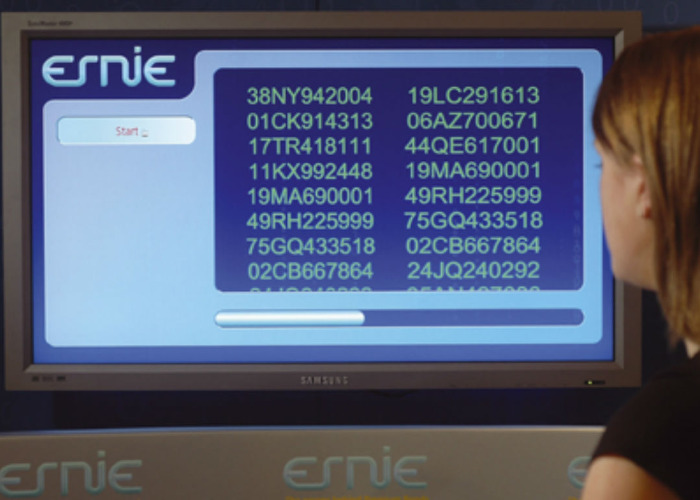

If you held the maximum of 50000 you would on average win one-two prizes a month although they would most likely all be 25. A Premium Bond is a lottery bond issued by the United Kingdom government since 1956. Amortizable bond premium is a tax term referring to the excess premium paid over and above the face value of a bond.

Before we get into the advantages lets take a look at the basics of how premium bonds work. Cash in Premium Bonds online or by phone. A premium bond trades above its face value.

Bonds usually trade for a premium if their interest rate is higher than the market. Since 2016 the personal savings allowance PSA has meant all savings interest is automatically paid tax-free. You only need to pay tax on it if youre a basic 20 rate taxpayer earning more than 1000 interest a year a higher 40 rate.

Premium Bond prizes the interest are paid tax-free. For both of these options youll already need to be registered with the NSI online and phone service and have your NSI holders number and password to hand. Prizes are drawn monthly and range from 25 to 1 million paid free of tax.

Over the life of the. Depending on the type of bond the premium can be tax. Premium Bonds are valued at 1 each and the minimum holding is 25 maximum 50000.

A premium bond is a bond that is selling for more than its par value on the open market. A premium bond is one that sells at a higher price than its par value typically 100 or principal. The maximum premium bonds you can hold is 50000.

The second winning Bond number drawn was 324MB318235 and the winner comes from West Sussex. The easiest way to cash in Premium Bonds is to call or use the online form. Premium on bonds payable or bond premium occurs when bonds payable are issued for an amount greater than their face or maturity amount.

This is caused by the bonds having a stated interest rate that is higher than the market interest rate for similar bonds. For every 1 of savings you invest youll get a unique bond number. At present it is issued by the governments National Savings and Investments agency.

Example of Premium on Bonds Payable. The winner holds 50000 in Premium Bonds and purchased their.

3 Ways To Buy Premium Bonds Wikihow

Fancy The Luck Of The Draw Premium Bonds Turn 60 Savings The Guardian

What Does It Mean When A Bond Is Selling At A Premium Is It A Good Investment

Premium Bonds Logo Stock Photo Alamy

The Reinsurance Actuary The Reinsurance Actuary

Selling Premium Bonds Best And Easiest Ways To Cash Them In And Withdraw Your Money Lovefood Com

We Waited 60 Years To Win 50 000 In The Premium Bonds Draw This Is Money

Hunt For The Premium Bond Winners Check If That Is You Itv News London

Ns I Premium Bonds Prize Checker Ns I Voice App Perf In United Kingdom By Shirkalab

The Premium Bond Conundrum Osborne Partners Capital Management Llc

Premium Bonds Limit Set To Rise To 40 000 Bonds The Guardian

Premium Bonds Prize Checker Who Are The March 2022 Winners Marca

Premium Vs Discount Bonds What S The Difference Investment U

Premium Bonds Ernie Hi Res Stock Photography And Images Alamy

How To Check Old Premium Bonds 11 Steps With Pictures Wikihow

How To Check Old Premium Bonds 11 Steps With Pictures Wikihow

Premium Bonds Definition Overview Valuation Calculations

Savings Watch Premium Bonds Money The Times

Premium Bonds A Better Bet For Savers When Interest Rates Are Low Moneyweek